The 50-30-20 Rule: A Simple Guide to Managing Your Finances

The 50-30-20 Rule: A Simple Guide to Managing Your Finances

When it comes to managing your finances, it can be overwhelming to know where to start. With so many expenses and financial goals to consider, it’s important to have a plan in place to ensure you’re making the most of your money. One popular approach to budgeting is the 50-30-20 rule, which provides a simple framework for allocating your income. In this article, we’ll delve into the details of the 50-30-20 rule and provide you with practical steps to get started today.

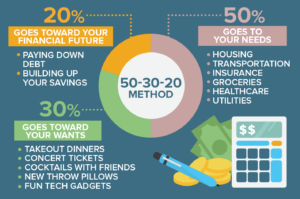

The 50-30-20 rule, also known as the balanced money formula, is a budgeting strategy that divides your income into three categories: needs, wants, and savings. According to this rule, you should allocate 50% of your income towards essential expenses, such as rent or mortgage payments, utilities, groceries, and transportation. These are the things that you absolutely need to survive and maintain a decent standard of living.

The next 30% of your income should be dedicated to wants or discretionary spending. This category includes non-essential expenses like dining out, entertainment, travel, and shopping. While these expenses are not necessary for survival, they contribute to your overall happiness and quality of life. By setting aside a portion of your income for wants, you can still enjoy the things you love without sacrificing your financial stability.

The remaining 20% of your income should be allocated towards savings and debt repayment. This category is crucial for building an emergency fund, saving for retirement, paying off debts, and investing for the future. By prioritizing savings, you can create a financial safety net and work towards achieving your long-term financial goals.

Implementing the 50-30-20 rule requires careful planning and discipline. The first step is to calculate your monthly income after taxes. This will give you a clear picture of how much money you have available to allocate according to the rule. Next, create a comprehensive list of your expenses, separating them into needs and wants. This will help you determine how much you are currently spending in each category and identify areas where you can potentially cut back.

Once you have a clear understanding of your income and expenses, it’s time to start allocating your money according to the 50-30-20 rule. Begin by setting aside 50% of your income for needs, making sure to cover all essential expenses. Then, allocate 30% towards wants, giving yourself some flexibility to enjoy the things you love. Finally, allocate the remaining 20% towards savings and debt repayment, ensuring that you are building a solid financial foundation for the future.

It’s important to note that the 50-30-20 rule is a guideline and can be adjusted based on your individual circumstances. If you have higher essential expenses or significant debt, you may need to allocate a larger portion of your income towards needs and debt repayment. The key is to find a balance that works for you and allows you to achieve your financial goals.

In conclusion, the 50-30-20 rule provides a simple and effective framework for managing your finances. By allocating your income into needs, wants, and savings, you can ensure that you are making the most of your money and working towards a secure financial future. Take the time to assess your income and expenses and start implementing the 50-30-20 rule today. Your financial well-being will thank you in the long run.

Understanding the 50-30-20 Rule

The 50-30-20 rule is a budgeting guideline that suggests dividing your after-tax income into three main categories: needs, wants, and savings. This rule provides a structured approach to managing your finances and can help you achieve a healthy balance between spending and saving.

Let’s delve deeper into each category and understand how they contribute to your overall financial well-being.

- 50% for Needs: This category includes essential expenses that are necessary for your basic well-being. These expenses typically include housing, utilities, transportation, groceries, and healthcare. Allocating 50% of your income to cover these needs ensures that you have a solid foundation and can meet your day-to-day obligations without any financial strain. It is crucial to prioritize this category as it directly impacts your quality of life and overall stability.

- 30% for Wants: The wants category covers discretionary spending that enhances your quality of life but is not essential for your survival. This includes expenses such as dining out, entertainment, travel, and non-essential shopping. While these expenses may not be necessary, they contribute to your happiness and personal fulfillment. By allocating 30% of your income to this category, you can indulge in the occasional treat or experience without jeopardizing your financial security.

- 20% for Savings: This category is dedicated to building your financial future and securing your long-term goals. It includes savings for emergencies, retirement contributions, debt repayment, and any other financial objectives you may have. By setting aside 20% of your income for savings, you are actively working towards financial freedom and ensuring that you have a safety net for unexpected expenses or future plans. This category plays a crucial role in providing you with financial stability and peace of mind.

By following the 50-30-20 rule, you create a balanced budget that allows you to meet your needs, enjoy some of life’s luxuries, and save for the future. It provides a clear framework for managing your income and ensures that you allocate your resources effectively. However, it is important to note that the 50-30-20 rule is a guideline and can be adjusted based on your individual circumstances and financial goals. It is always recommended to review and adapt your budget periodically to reflect any changes in your income or expenses.

Step 6: Seek Professional Advice

If you’re struggling to implement the 50-30-20 rule or find it challenging to stick to your budget, consider seeking professional advice. Financial advisors or budgeting experts can provide valuable insights and guidance tailored to your specific financial situation. They can help you identify areas where you can further optimize your spending and offer strategies to achieve your financial goals more effectively.

Step 7: Stay Committed to Your Financial Goals

Implementing the 50-30-20 rule requires discipline and commitment. It’s important to stay focused on your financial goals and resist the temptation to overspend on unnecessary items. Remind yourself of the long-term benefits of saving and investing, such as financial security and the ability to achieve your dreams and aspirations. Stay motivated by regularly reviewing your progress and celebrating milestones along the way.

Step 8: Continuously Educate Yourself

Personal finance is a dynamic field, and there are always new strategies and techniques emerging. To ensure you’re making the most of your money and staying on track with the 50-30-20 rule, make a commitment to continuously educate yourself about personal finance. Read books, listen to podcasts, attend seminars, and follow reputable financial experts to stay informed about the latest trends and best practices. (Additional eBooks are Available in the Freedom Funds Hub Shop)

Step 9: Adapt the Rule to Your Unique Circumstances

While the 50-30-20 rule provides a general guideline for budgeting, it’s essential to adapt it to your unique circumstances. Everyone’s financial situation is different, and you may need to make adjustments based on factors such as your income level, debt obligations, and short-term financial goals. Be flexible and willing to modify the rule to align with your specific needs and priorities.

Step 10: Enjoy the Benefits of Financial Freedom

By implementing the 50-30-20 rule and maintaining a balanced budget, you’ll not only achieve financial stability but also enjoy the benefits of financial freedom. You’ll have peace of mind knowing that you’re living within your means, saving for the future, and making progress towards your financial goals. With this newfound freedom, you can focus on other aspects of your life, such as pursuing your passions, spending quality time with loved ones, and creating meaningful experiences.

5. Reduced Financial Stress

One of the major benefits of following the 50-30-20 rule is the reduction of financial stress. By clearly allocating your income and prioritizing savings, you can avoid living paycheck to paycheck and have peace of mind knowing that you have a plan in place for your financial future.

6. Increased Financial Freedom

Following the 50-30-20 rule can also lead to increased financial freedom. By consistently saving 20% of your income, you are building a financial cushion that can provide you with more options and opportunities in the future. Whether it’s taking a dream vacation, starting a business, or pursuing further education, having savings allows you to have more control over your financial decisions.

7. Long-term Wealth Accumulation

By prioritizing savings and investing 20% of your income, the 50-30-20 rule sets you on a path towards long-term wealth accumulation. Over time, the money you save and invest can grow through compound interest, providing you with the potential for financial independence and a comfortable retirement.

8. Improved Financial Habits

Implementing the 50-30-20 rule requires discipline and consistency. By following this rule, you develop a habit of living within your means and making intentional financial decisions. This can lead to improved financial habits overall, such as avoiding unnecessary debt, practicing mindful spending, and being more conscious of your financial goals.

9. Enhanced Financial Security

By setting aside 20% of your income for savings, you are creating a safety net for unexpected expenses and emergencies. This financial security can provide you with peace of mind and protect you from financial setbacks. It also allows you to be better prepared for any future challenges or opportunities that may arise.

10. Financial Empowerment

Following the 50-30-20 rule empowers you to take control of your finances and make informed decisions about your money. It gives you a sense of ownership and responsibility over your financial well-being, allowing you to create a brighter and more secure future for yourself and your loved ones.

In conclusion, the 50-30-20 rule offers numerous benefits, including clear allocation of income, flexibility, debt reduction, improved financial awareness, reduced financial stress, increased financial freedom, long-term wealth accumulation, improved financial habits, enhanced financial security, and financial empowerment. By implementing this rule, you can take control of your finances and work towards achieving your financial goals.

Additional Tips for Financial Success

While the 50-30-20 rule provides a solid foundation for managing your finances, here are a few additional tips to enhance your financial success:

1. Create a Detailed Budget

In addition to the 50-30-20 rule, consider creating a detailed budget that outlines your income and expenses. This will give you a comprehensive view of your financial situation and help you identify areas where you can make further adjustments.

A detailed budget allows you to track your spending habits and identify areas where you may be overspending. By categorizing your expenses, you can see exactly how much you’re spending on necessities, such as housing, transportation, and groceries, as well as discretionary items like dining out and entertainment. This level of detail can help you identify areas where you can cut back and allocate more funds towards savings or debt repayment.

2. Prioritize High-Interest Debt

If you have high-interest debt, such as credit card balances, prioritize paying it off as quickly as possible. Allocate a larger portion of your savings category towards debt repayment until you are debt-free. This will save you money on interest payments and improve your overall financial health.

High-interest debt can be a significant drain on your finances, as the interest charges can quickly accumulate. By prioritizing debt repayment, you can free up more money to put towards savings or other financial goals. Consider using the debt snowball or debt avalanche method to pay off your debts systematically, starting with the one that has the highest interest rate or the smallest balance.

3. Automate Your Savings

To ensure consistent savings, set up automatic transfers or deductions from your paycheck to your savings or investment accounts. This will make saving effortless and help you stay on track towards your financial goals.

Automating your savings is a powerful tool to help you save consistently and avoid the temptation to spend the money elsewhere. By setting up automatic transfers, you can ensure that a portion of your income goes directly into your savings or investment accounts before you have a chance to spend it. This can help you build an emergency fund, save for a down payment on a house, or invest for retirement.

4. Review and Adjust Regularly

Financial circumstances can change over time, so it’s important to review and adjust your budget periodically. Life events such as a new job, a pay raise, or a major expense may require you to make adjustments to your allocations. Stay proactive and make changes as needed to maintain financial balance.

Regularly reviewing and adjusting your budget allows you to adapt to changes in your financial situation. If you receive a pay raise, for example, you may want to allocate a portion of the additional income towards savings or debt repayment. On the other hand, if you experience a decrease in income, you may need to make temporary adjustments to your budget to ensure you can cover your essential expenses.

5. Seek Professional Advice

If you’re struggling to manage your finances or have complex financial goals, consider seeking advice from a financial professional. They can provide personalized guidance and help you create a plan that aligns with your specific needs and aspirations.

A financial professional can offer valuable insights and expertise to help you navigate complex financial situations. Whether you’re planning for retirement, saving for your child’s education, or looking to optimize your investment portfolio, a financial advisor can provide tailored advice and strategies to help you achieve your goals. They can also help you stay accountable and provide ongoing support as you work towards financial success.

Once you have calculated your after-tax income, it’s time to implement the 50-30-20 rule. This rule suggests that you allocate 50% of your income towards your needs, 30% towards your wants, and 20% towards your savings. Let’s break it down further.

First, let’s focus on your needs. These are the essential expenses that you cannot live without, such as rent or mortgage payments, utilities, groceries, transportation, and healthcare. Allocate 50% of your income towards these expenses. It’s important to prioritize your needs and ensure that you have enough to cover them comfortably.

Next, let’s move on to your wants. These are the non-essential expenses that bring you joy and enhance your quality of life, such as dining out, entertainment, shopping, and travel. Allocate 30% of your income towards these wants. While it’s important to enjoy life and treat yourself, it’s also crucial to be mindful of your spending and avoid going overboard.

Finally, let’s talk about savings. Allocating 20% of your income towards savings is a crucial step in building a secure financial future. This includes saving for emergencies, retirement, and any other long-term goals you may have. Consider setting up automatic transfers to a separate savings account to make it easier to save consistently.

By following the 50-30-20 rule, you are creating a balanced approach to managing your finances. This rule allows you to meet your immediate needs, enjoy some wants, and save for the future. It’s important to regularly review your budget and make adjustments as needed. Life circumstances and financial goals may change, so it’s essential to stay flexible and adapt your budget accordingly.

Remember, the key to financial success is dedication and discipline. It may take time to adjust to this new way of managing your finances, but the long-term benefits are worth it. Start today by implementing the 50-30-20 rule and take control of your financial future. With careful planning and consistent effort, you’ll be well on your way to achieving your goals and enjoying a better financial future.

–

–

M1 Finance is offering up to $100 when you open an account and deposit any amount of money today! Click the link to Start Your Financial Freedom: http://bit.ly/48I8v9c

–

“Freedom Funds Hub” respects copyright law and encourages users to do the same. All materials on the platform, including text, images, videos, and other content, are protected by copyright. Users must obtain proper authorization before reproducing, distributing, or modifying any copyrighted material found on Freedom Funds Hub. Proper attribution is required when citing or referencing copyrighted content. Fair use of copyrighted material is permitted for certain purposes, such as criticism, comment, news reporting, teaching, scholarship, or research. However, users are responsible for ensuring compliance with copyright law and may face consequences for infringement. By accessing Freedom Funds Hub, users agree to adhere to these copyright regulations and respect the intellectual property rights of content creators.“

Average Rating